If you've ever watched Shark Tank on TV, you are aware of the commitment and work that business owners make while showcasing their companies to potential investors. How To Find Venture Capital Funding Investors may choose to contribute money in exchange for a share in a firm after assessing its organization, product, and growth potential.

Not only is the show hilarious, but it's also a fantastic way to learn about venture capital (VC). If your business is brand new, you might be wondering how to raise venture capital (VC) to fund its rapid growth. To discover more about venture capital, keep reading.

How to Find Venture Capital Funding: What it is, how a venture capitalist works, the various stages of capital investments, and how to determine, without going on TV, whether VC funds are a good fit for your business plan!

Unlocking the Secrets of Venture Capital Funding

What is venture capital?

One sort of funding available to businesses and entrepreneurs is venture capital (VC). Funders can also be private investors or venture capital firms that look for potential companies to add to their portfolio.

How to Locate Funding for Venture Capital Venture capital businesses manage funds from many sources, such as foundations, corporations, high-net-worth individuals, and pension funds.

Then, individuals invest this money in exchange for stock shares or ownership in the companies of their choice. According to their ownership stake, they may own 5% or 50% of the company.

Venture capital, private equity, and investment banking

Both phrases refer to different forms of corporate funding, despite the fact that they are frequently confused. Understanding the differences is essential when seeking funding for your business.

- Capital for taking risks: Venture capitalists prioritize making investments in startups and businesses that have room to grow. The investment amounts might range from a few hundred thousand to a few million dollars, depending on the stage of the funding process and the size of the company. Additionally, while venture capital firms are able to purchase a full share in a business, they usually purchase a minority position and use their network and expertise to support the company's growth.

- Exclusive ownership: These multimillion- or multibillion-dollar investments are concentrated in well-established businesses. The corporation often asserts majority ownership and boosts decision-making authority in private equity agreements. Furthermore, private equity firms regularly provide financing to companies that are neither listed nor traded publicly. Private equity firms would occasionally make investments in publicly traded companies, acquiring enough shares to seize control of the business and then delisting it from public stock markets.

- Investment banks: There are a few key differences between banks and venture capitalists, even though they commonly work together to give finance, and many of them have prior experience as investment bankers. Banks offer loans, which come with interest and must be repaid. Compared to investment bankers, who are more inclined to lend to companies with a track record of success, venture capitalists may be more eager to take a chance as early investors in startups.

Portfolio companies

The businesses that comprise a venture capital firm's portfolio are the only things in which the firm has made investments. Several venture capitalists are focused on the businesses in their portfolios.

While some focus primarily on a particular industry, others may allocate a significant portion of their assets to startups. By studying their portfolio companies, you can focus your efforts on the venture capital firms that are the best fit for your company.

Read also: Types Of Startup Funds In The Usa.

What do venture capital firms do?

Some venture capitalists concentrate on specific industry sectors, like biotechnology, software, computers, the internet, and green energy. Venture capitalists are open to considering any kind of business that wants to grow, innovate, or launch.

How to Find Venture Capital Funding: How To Find Venture Capital Funding The companies make money from their investments after taking stock in them, as well as from the management fee they charge investors to run the fund.

Venture capitalists and VC businesses are subject to US regulation. The Securities and Exchange Commission is subject to the same laws as other financial institutions that forbid insider trading and money laundering.

Who is who in the venture capital industry?

Individual investors

Some affluent individuals, sometimes known as angel investors, invest their own funds in businesses they feel have exceptional growth potential.

These investors can provide essential managerial and commercial skills, having often been successful business entrepreneurs themselves.

How to Obtain Venture Capital Funding Startups usually receive smaller sums of money from angel investors.

investors who work with organizations

Insurance companies, foundations, endowments, pension funds, and state-owned investment organizations are examples of institutional venture capital investors.

companies that offer venture capital

Entities that manage and invest in a portfolio of enterprises make up the vast majority of venture capital investors. In venture capital businesses, you will encounter people working in a variety of roles. Let's look at a few of the most common ones:

- Associated: A partner is a senior member who has the authority to choose which venture capital investments to make. Frequently referred to as general partners, their experience typically comes from venture capital or investment banking. They run the risk of being sued and have to act in the best financial interest of the company. In addition, certain partners are called limited partners. They are the investors who provide the fund with capital. These could be institutional investors, such as foundations or pension funds, or they could be high-net-worth individuals with limited connections to venture capital firms. Unlike general partners, limited partners are not involved in the day-to-day operations of the company.

- Fundamental: Principals work with partners to identify, evaluate, and close funding agreements. They could also be on portfolio companies' boards or act as operational consultants. Because they have the requisite experience from their regular job at the business, many principals will eventually become partners.

- Coworker: Young workers in the organization who perform tasks like transaction analysis, market research, and due diligence on potential investments are referred to as associates. Associates may also help the company with fundraising and portfolio management. Many university graduates with finance and economics backgrounds will go on to become principals and partners in venture capital firms.

Which companies seek money from venture capital?

The amount, sector, or growth stage of venture capital is unrestricted. Both small and large companies seek out and accept venture capital.

However, certain business models often lend themselves particularly well to venture capital (VC) funding. The majority of companies that obtain funding from venture capital are startups. How To Find Venture Capital Funding How to Find Funding for Venture Capital Projects According to the National Venture Capital Association (NVCA), 70% of investments in 2021 went into early-stage businesses.

It would appear to follow that businesses with less room for growth than startups and other new endeavors are those that are just getting started or have not yet gained a sizable market share.

Read also: Strategies for Successful Small Business Fundings.

Advantages and disadvantages of venture capital funding

As with any financial transaction, venture capital has its pros and cons. Being aware of the benefits and drawbacks can help you make better informed and shrewd decisions when it comes to obtaining funding for your business.

Benefits

- You should invest less of your own money. It goes without saying that obtaining an outside investment can help your business grow. You may focus entirely on your company, so you don't have to worry about your personal finances becoming stressed.

- Venture capital creates connections for you. When venture capital investors provide you with support, they have an interest in your success. One of the primary duties of venture capitalists is to establish a network. This network can assist you in hiring employees, attracting customers, and identifying profitable business partnerships.

- Businesses can benefit from venture capital firms in ways beyond only obtaining financing: "You gain access to knowledge and experience." Deals often involve key knowledge in the areas of networking, managerial strategy, and commercial abilities.

- VC money is never reimbursed. Unlike loans, venture capital investments are not meant to be repaid. You can use the money for business development; however, unlike traditional bank loans, there is no collateral requirement. In exchange, the VC firm or investor receives an ownership stake in your company.

- Your business may have improved its valuation. A company that has a reputable venture capital firm supporting it may have an increased chance of doing business with other potential investors, partners, and clients. "Your company's valuation might have increased." A venture capital company's network and reputation can help its portfolio companies, which in turn can raise their valuation.

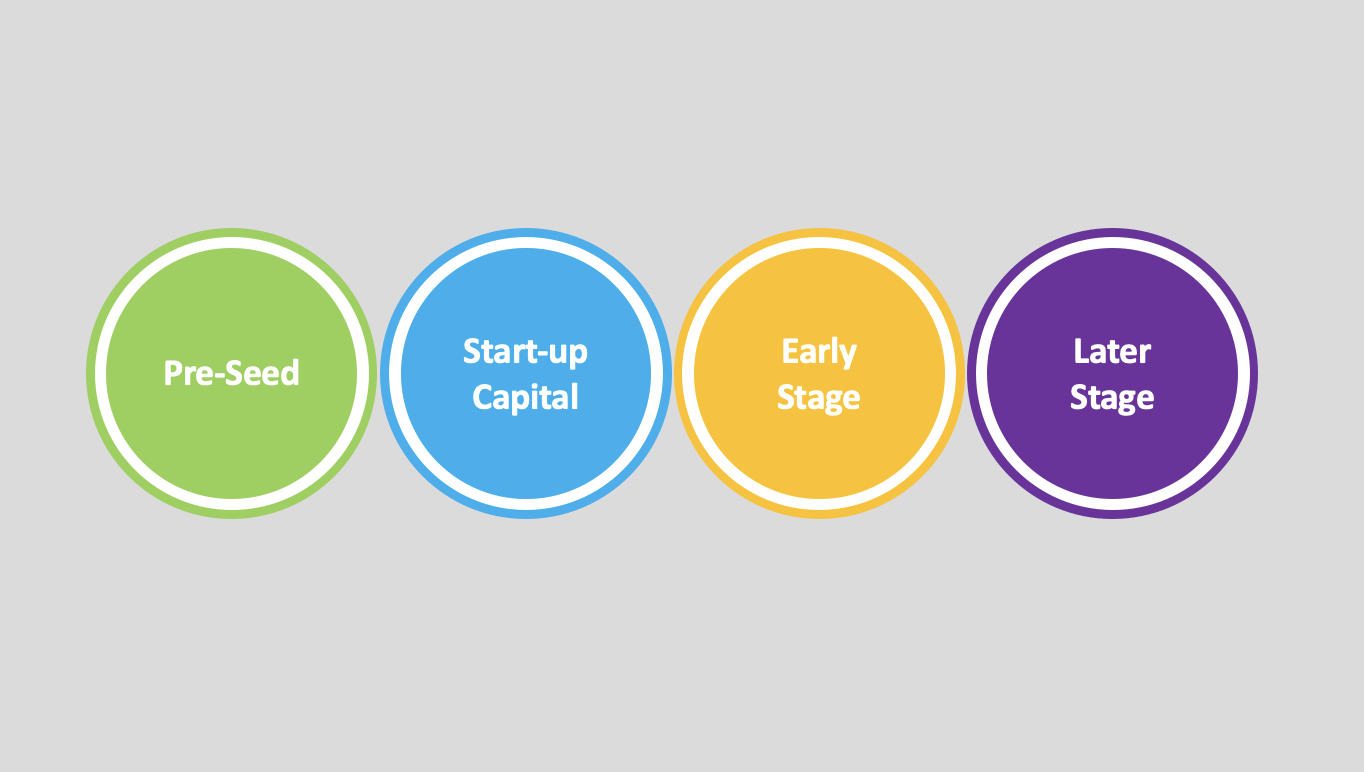

The stages of venture capital financing

There's a common misconception that venture capital firms only invest in new or start-up companies. However, venture capital funds can support companies at any stage of development, including startups and established businesses seeking to expand. Additionally, many companies go through multiple investment rounds as they develop. Read on to learn about the different stages of fundraising and how different company models can be supported by them.

Pre-seed funding

Before a company is even officially launched, there are costs and fees involved. How To Find Venture Capital Funding Pre-seed investment gives entrepreneurs money and professional help to write a business plan, conduct market research, and design products for their company. Entrepreneurs frequently wonder when to look for pre-seed investments.

How to Find Venture Capital Funding: Although there are no set guidelines, it is helpful if a company has a few things in place before this stage. One of these is a minimum viable product (also called an MVP), which is a basic version of the product that allows investors to determine its viability.

Seed funding

A startup with a promising idea can use seed-round finance, which is the first significant round of funding for most businesses, to pay for things like additional product development or market analysis. How To Find Venture Capital Funding How to Obtain Venture Capital Funding In addition, investors' knowledge and mentoring are often provided during this stage, which is a great advantage for company owners who may be new to entrepreneurship.

The funding is just getting started.

During this phase, which is usually divided into two rounds, venture capitalists invest in companies that are already operating but have room to grow and a short operating history.

The money raised during this phase is used to grow the company; the first round, known as Series A, involves more capital and higher risk and is sometimes combined with seed funding.

The second round, known as Series B, helps successful businesses expand into new markets.

Late-stage investment acquisition

Lastly, late-stage funding is intended for businesses that require capital for further growth and development.

It is commonly employed for financially taxing expansions like acquiring another company, entering a new market, or getting ready to list stock on an initial public offering (IPO).

Venture capitalists usually look for lower-risk investment opportunities at this stage, ideally with well-established businesses that have a consistent history of operations.

Read also: The Essential Guide to Startup Funding Rounds.

In seven steps, how can one find and secure venture capital investment?

It takes a lot of work to get a firm off the ground, and that's before we ever think about looking for venture capital funding.

It can be challenging to find and get venture capital funding, but it's not always easy, especially for businesses that are venturing into the venture capital markets for the first time.

1. Ascertain whether venture capital funding is suitable for your business.

Venture capital may be a beneficial solution for entrepreneurs who are having trouble raising capital for their businesses, but you should be aware of some of the disadvantages and risks.

Can you commit the necessary time and energy to finding the right venture capital partnership? Are you willing to give up ownership of your company to an investor in addition to the money invested?

2. Identify your target market.

As a venture capital firm is looking for companies with high potential returns on their investments, be prepared to answer questions about your predictions for the market's future and the ways in which your company is set up to benefit from them. Make sure you understand both your company's sales potential and how it meets the needs of your target market.

A venture capital firm will want proof of your due diligence and an understanding of how your offering will fit into the existing market. How To Find Venture Capital Funding Keep in mind the possibility of future market expansion.

3. Look into venture capital companies and investors.

While it may be tempting to reach out to as many people as possible, narrowing down your search for funding will save you time.

There are variations among venture funding sources. Look into the venture capital firms that work in your industry and understand the differences between private equity funds, firms, and individual investors.

You'll need to know their portfolio companies, track record, and focus in order to prepare for the next steps.

4. Make a strong pitch.

In order to access venture capital markets, you must convince potential investors that your business strategy, target market, and organizational structure will allow them to expand and flourish.

5. Prepare for your investigation.

When a venture capitalist (VC) expresses interest in your company, they will want to do additional independent research. This process, called due diligence, helps convince potential investors that your company is a prudent investment.

The due diligence study will review financial statements, contracts, business strategies, operating costs, and personnel records. You can save time by organizing this information in advance so that it is accessible when needed.

6: Choose the language.

When a venture capital firm shows interest in your company, it's time to handle the investment contract. Venture financing contracts can be complicated and drawn out.

There may be negotiations based on the funding schedule, managerial experience, valuation, equity stake, and board seats. A lawyer can assist you in ensuring that the agreement's terms are acceptable to you and that you are prepared to follow through on them.

7. Complete the transaction.

Once the conditions are finalized, you will need to complete the necessary documentation, obtain the funds, and utilize them to grow your business!

FAQ's: How To Find Venture Capital Funding

How do I find a VC for funding?

- Search for VCs that invest in your type of industry.

- Make a target list of those VCs.

- Corroborate yours and their stage of investment.

- Research your VC's recent investments.

- Geographic segmentation.

- Shortlist.

- Reach out.

- Connecting through mutuals and acquaintances.

Where can venture capital funding be obtained?

Large organizations, including pension funds, insurance companies, financial corporations, and university endowments, are common investors in venture capital funds; each of these groups allocates a tiny portion of their overall assets to high-risk ventures.

How do I ask for VC funding?

For instance, if they concur with your needs assessment, the general procedure is as follows: Determine the estimated monthly burn rate for the business, select a significant value-creation milestone for the next 12 to 18 months, and then request enough funding to establish a runway for a brief period of time beyond that point.

How do I get capital venture funding?

- Find an investor. Look for individual investors—sometimes called “angel investors"—or venture capital firms.

- Share your business plan.

- Go through the due diligence review.

- Work out the terms.

- Investment.

How do startups get venture capital?

A company can get in touch with a venture capital firm or investor in a number of ways, including by cold emailing them. Making connections during a trade show. receiving a recommendation from a member of your network.