Modelling from energy consultancy Cornwall Insight, included in its quarterly GB Benchmark Power Curve report, forecasts offshore wind topics will increase from 12.5GW in 2023-24 to 47.1GW in 2030, narrowly missing the government’s 2030 goal.

The report appeared to find that delays in offshore wind deployment in the short to medium term unsalaried to the missed target. These delays are largely attributed to rising costs, most recently reflected in the 5th Contract for Difference (CfD) vendition round, which saw no offshore wind taking part, as well as the receipt of one of the UK’s largest offshore wind farms Norfolk Boreas, with the developers saying it no longer made financial sense.

Offshore wind shortfall 'could delay UK net zero

The slower progress will raise stat emissions, wearing the endangerment of meeting stat targets and ultimately extending the time it takes to reach net zero.

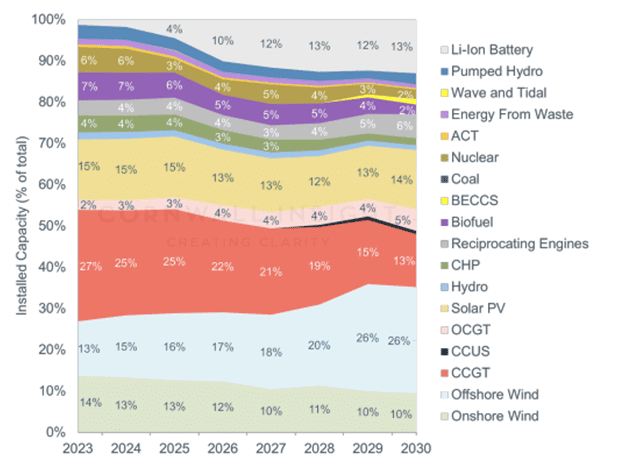

Despite the concerns, offshore wind is forecast to wilt the largest source of electricity in topics terms by 2028, making up 26% of the GB generation topics by the end of the decade.

Future electricity generation topics dispersal (Source: Cornwall Insight Benchmark Power Curve).

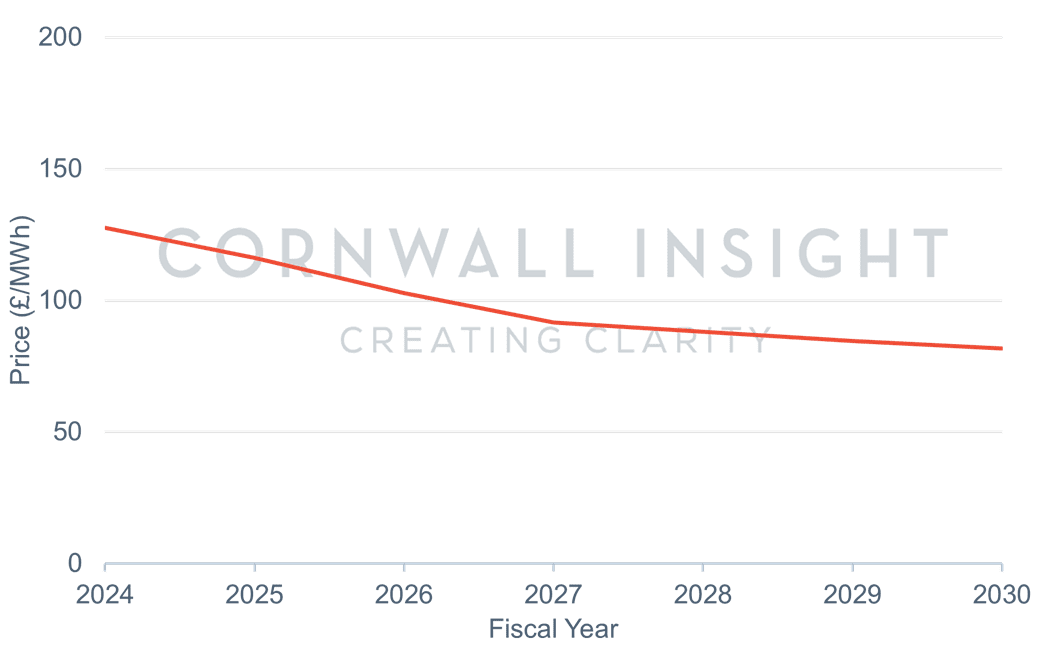

Alongside electricity generation mix, the report analyses power prices and has projected power prices will linger at least 60% whilom pre-2021 averages until 2030 and likely beyond. The modelling from Cornwall Insight’s third 2023 Benchmark Power Curve, shows little movement from older in the year, with prices expected to peak at nearly £130 per MWh in 2024, surpassing falling to a low of just over £80 per MWh by 2030. While this does mark a large decrease, it remains substantially higher than the pre-energy slipperiness levels of less than £50 per MWh.

Power price forecasts – stereotype price per fiscal year (Source: Cornwall Insight Benchmark Power Curve).

Tom Edwards, Senior Modeller at Cornwall Insight: “Offshore wind delays, spurred on by forfeit worries and project setbacks, pose a roadblock to reaching net zero. We can see the country is travelling in the right direction towards a renewables-based electricity system, however, our estimates protract to show it is simply not fast unbearable to unhook on government targets.

“Time is of the essence, and it is hair-trigger that the government reassess its transferral to progressive renewable energy adoption, which includes stuff increasingly flexible when setting vendition parameters to reach the UK’s offshore wind goals.

“Rolling when our net-zero ambitions and slowing our transition yonder from fossil fuels is likely to be a plush wait that will not only see us fall remoter overdue in decarbonising the country but will leave consumers shouldering the prolonged undersong of upper prices. Without a resolute transferral to a greener and increasingly sustainable future, achieving net zero emissions and pre-crisis energy bills becomes an increasingly elusive goal.”